VA Home Loans: Protect Your Dream Home with No Exclusive Home Mortgage Insurance Policy

VA Home Loans: Protect Your Dream Home with No Exclusive Home Mortgage Insurance Policy

Blog Article

Understanding Exactly How Home Loans Can Promote Your Trip In The Direction Of Homeownership and Financial Security

Browsing the complexities of home fundings is essential for any individual desiring accomplish homeownership and develop financial security. Various kinds of financings, such as FHA, VA, and USDA, offer distinct advantages tailored to different scenarios, while comprehending rate of interest and the application process can significantly affect the total cost of a home. Managing your mortgage efficiently can lead to long-lasting financial benefits that expand past simple ownership. As we think about these crucial components, it ends up being clear that the path to homeownership is not nearly protecting a loan-- it's about making informed options that can shape your monetary future.

Sorts Of Home Loans

Standard loans are a prominent option, normally needing a higher credit report and a down settlement of 5% to 20%. These loans are not insured by the federal government, which can lead to stricter qualification criteria. FHA loans, backed by the Federal Real Estate Administration, are developed for novice buyers and those with lower credit rating, permitting down settlements as low as 3.5%.

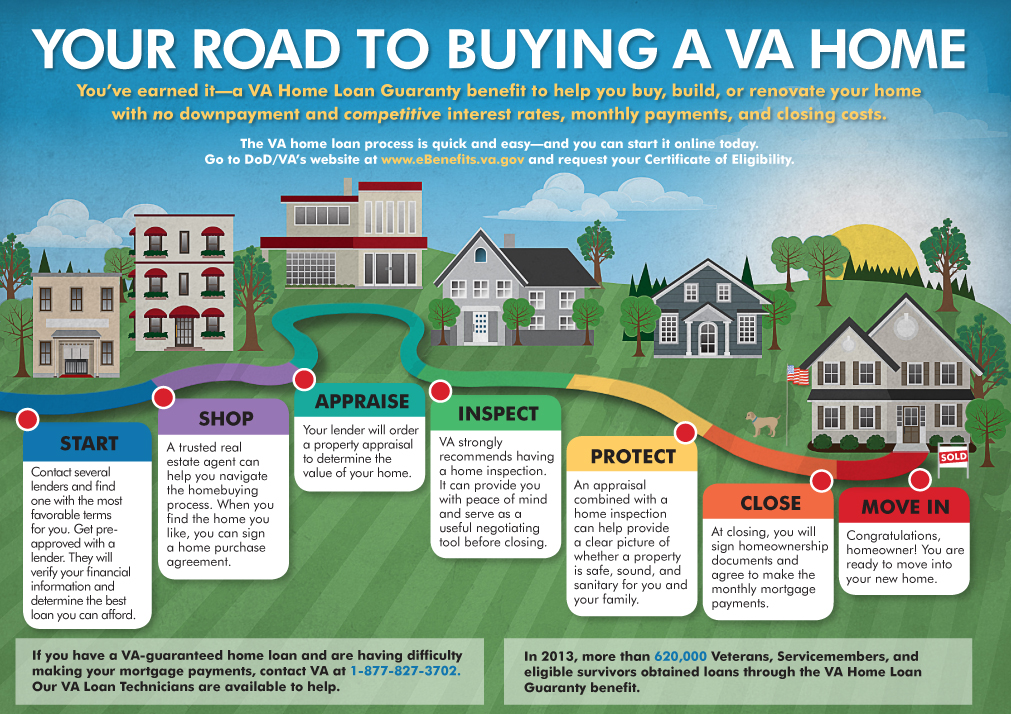

VA loans, readily available to veterans and active-duty armed forces employees, use positive terms such as no private home mortgage and no down settlement insurance (PMI) USDA financings deal with rural homebuyers, promoting homeownership in less largely booming locations with low-to-moderate income degrees, additionally calling for no down repayment.

Finally, variable-rate mortgages (ARMs) use reduced initial prices that change with time based upon market conditions, while fixed-rate home mortgages provide secure month-to-month payments. Comprehending these choices enables prospective property owners to make informed decisions, aligning their financial objectives with the most ideal loan kind.

Recognizing Interest Rates

Rate of interest play a critical duty in the home mortgage procedure, considerably influencing the overall price of borrowing. They are essentially the price of borrowing money, expressed as a portion of the car loan quantity. A lower rate of interest can cause considerable cost savings over the life of the car loan, while a greater rate can result in boosted monthly payments and complete interest paid.

Rate of interest prices vary based on various variables, including economic conditions, rising cost of living rates, and the monetary policies of central banks. A set rate stays constant throughout the financing term, supplying predictability in month-to-month payments.

Comprehending how rates of interest work is important for possible property owners, as they straight influence cost and financial preparation. It is recommended to contrast prices from various lenders, as even a minor distinction can have a considerable effect on the overall cost of the funding. By following market patterns, debtors can make informed decisions that line up with their economic objectives.

The Application Process

Navigating the home mortgage click this link application procedure can originally seem overwhelming, yet recognizing its key components can streamline the trip. The initial action involves gathering required documents, consisting of proof of revenue, income tax return, and a checklist of responsibilities and assets. Lenders require this information to review your financial security and creditworthiness.

Next, you'll need to pick a lender that aligns with your monetary needs. Research various home mortgage products and rate of interest, as these can significantly affect your month-to-month repayments. As soon as you choose a lender, you will certainly finish a formal application, which might be done online or face to face.

When your application is approved, the loan provider will issue a loan price quote, laying out the prices and terms related to the home mortgage. This critical paper enables you to analyze your choices and make educated decisions. Efficiently navigating this application process lays a strong structure for your trip towards homeownership and financial stability.

Handling Your Home Loan

Managing your mortgage effectively is essential for maintaining economic wellness and making certain long-term homeownership success. A positive technique to home mortgage monitoring includes understanding the regards to your finance, including rate of interest, settlement routines, and any kind of potential costs. Frequently examining your mortgage declarations can help you stay notified regarding your staying equilibrium and settlement background.

Creating a budget that accommodates your home loan repayments is vital. Make certain that your regular monthly budget plan consists of not just the principal and interest however also residential or commercial property taxes, home owners insurance policy, and maintenance expenses. This thorough sight will avoid monetary strain and unforeseen expenses.

This method can dramatically reduce the overall passion paid over the life of the funding and reduce the repayment duration. It can lead to lower regular monthly settlements or an extra favorable funding term.

Last but not least, maintaining open interaction with your lender can supply clarity on choices offered need to economic difficulties occur. By actively handling your home mortgage, you can boost your financial security and reinforce your course to homeownership.

Long-Term Financial Perks

Homeownership provides substantial long-lasting financial benefits that prolong past plain shelter. This equity acts as a monetary asset that can be leveraged for future investments or to fund major life occasions.

Additionally, homeownership gives tax obligation benefits, click over here such as home mortgage interest deductions and property tax deductions, which can significantly lower a homeowner's taxed earnings - VA Home Loans. These reductions can cause substantial cost savings, boosting overall financial security

Furthermore, fixed-rate home loans protect home owners from climbing rental costs, guaranteeing predictable monthly repayments. This security enables people to budget plan successfully and plan for future expenditures, assisting in long-lasting financial goals.

Homeownership also cultivates a feeling of area and belonging, which can result in boosted public engagement and support networks, better adding to economic health. Ultimately, the economic advantages of homeownership, including equity development, tax obligation advantages, and price stability, make it a cornerstone of lasting financial safety and security and riches accumulation for family members and individuals alike.

Conclusion

In conclusion, recognizing home financings is important for browsing the path to homeownership and attaining financial stability. Additionally, effective home mortgage administration and recognition of long-term economic advantages contribute dramatically to constructing equity and fostering area involvement.

Navigating the intricacies of home lendings is important for anybody aiming to accomplish homeownership and establish economic stability. As we think about these important components, it becomes clear that the path to homeownership is not just about protecting a finance-- it's concerning making notified selections that can form your monetary future.

Recognizing just how passion prices work is vital for prospective home owners, as they directly influence affordability and economic preparation.Managing your mortgage properly is crucial for preserving economic health and making sure lasting homeownership success.In verdict, comprehending home lendings is important for browsing the look at this web-site path to homeownership and achieving financial security.

Report this page